Sensys Blog

Subscribe to RSS headline updates from:

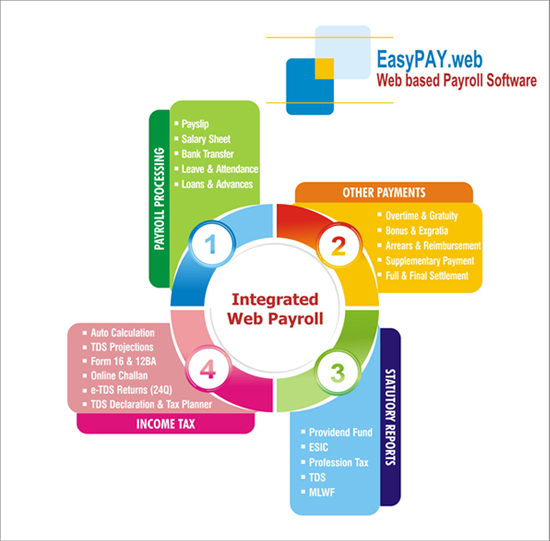

HRMThread - Web based Payroll

Management Software

HRMThread is very easy, flexible and user-friendly Web based Payroll Management

software that takes care of all your requirements relating to accounting and management

of employee’s Payroll. This versatile, user friendly, package, offers user defined

Earning / Deduction / Loan Heads & Calculation Formulae / Tables. The package

generates all the outputs & statutory reports required by a Payroll application.

Key Feature Details:

Flexible Structure building capability of Earnings

& Deductions

Flexibility to add or modify any number of Salary Components - Earnings

& Deductions

User Defined Entry Field with unmatched flexibility for Formula, percentage

or Customized Calculation

Taxable & Non Taxable Earnings for Income Tax Calculations

Payslip / Non Payslip Component

Calculation based on Attendance

Monthly or Yearly Payments

Frequency of Salary Head

Also compute various other components that do not appear in Payslip

Leave & Attendance Management

Leave Rules can be defined

Yearly Credit of Leave/ Pro rata basis

Monthly Increment of Leave on Pro-rata basis

Carry forward facility for balance leave

Encashment of Leave / Encashment In excess of Leave

Leave Utilizes & Balances can be checked

CL, PL, SL, Compensatory & Customizable Leaves

Automatic Leave payout on termination of Employees (in Full &

Final Settlement)

Swipe card / Attendance machine if any can be linked to our software

Attendance Arrears

Monthly Attendance Register & Yearly Attendance Summary

Attendance / Leave Ledger

Submission of online Leave Application and supporting

workflow.

Loan & Advance Management

User Definable Loans/Advances (Multiple)

Loan Disbursement option with EMI option

Automatic recovery of EMI & stops automatically once the Loan

amount is totally recovered

Auto calculation of Interest on Loans based on Flat Interest, Reducing

Balance

Lumsum recovery of Loan

Interest free Loan Perquisites as per Income Tax

Loan Recovered, Loan Balances & Loans History

– Employee wise Loan Ledger. Online submission of Loan Application and supporting

workflow.

Payroll Processing

Input information for all newly joined employees and resign left employees

Create a new payroll month & Process Salary

Over-ride facility for any Salary components

Salary on Hold & Freezing of Salary in case of Termination of

Employees

Process by Exception - you only need to enter Pay and/or deduction

information when there are changes

Pro-rata calculations for employees based on Absenteeism

Process & Print Payslips for groups or for selected employees

Lock month facility to avoid changes in Processed

Data

Salary Reports (Payslip & Salary Sheet)

Automatically calculates all the income, deductions & Company

Contributions as per the requirement

Regular Payslips (with Logo) can be viewed or Emailed

Reimbursement Payslips can be viewed or Emailed

User defined Salary Sheets can be viewed

Generates Cash / Cheque / Bank Transfer List

Generate Bank Statement, Direct Electronic Bank transfer files &

Covering Letter for Banks

YTD salary Sheet & Summary of each employee

Separate Payslips can be generated for Arrears, Medical, Reimbursement

& LT

Bank Transfer

Bank Transfer Statement facility available for all the banks

Soft copy format also available in Excel or any format specified by

different banks

Bank Transfer Statements can be generated for both Regular, Reimbursement

Payments & Supplementary Payments

Covering Letters

Cheque / Bank Transfer / Cash List

Reimbursement Management

Multiple Reimbursement Components like Medical , LTA & Customizable

Reimbursement Components

Upper limits can be specified – Employee wise or Grade wise

Annual Limits or Monthly Accruals

Opening Balance, Entitlement, Amount Reimbursed and Balance amount

can be checked

Reimbursement Payslips, Bank transfer statement for Reimbursement

Component

Arrears Calculation

Arrears calculation for any previous period / Retrospective effect

Separate Payslips can be generated for the Arrears Components

Bank transfer statement for Arrears Component

Other Payments

Overtime Calculation

Gratuity, Bonus & Exgratia Calculation

Reimbursement - Medical, LTA or any other user definable reimbursement

Supplementary Payments

Monthly Reconciliation - allow us to compare the changes in the pay

components from last month to this month or for any number of months

PF Calculation & Reports

User defined PF Rate of Deduction for Employer & Employee

Employee & Employer Contribution

Automatic Bifurcation of EPF & EPS

PF applicability check at Employee Level

Options to Limit Maximum Salary for PF Deduction

Form 5, 10, 12A, 3A, 6A, Challan & Reconciliation

Statement

ESIS Calculation & Reports

User defined ESIC Rate of Deduction for Employer & Employee

ESIC applicability check at Employee Level

ESIC Register, Form 5, 6 & Challan

Professional Tax

User definable State wise Slab

PT applicability check at Employee Level

Form III & Challan

Income Tax Management

Auto calculations of Exemptions & Deductions and compute income

tax payable for the entire year & the tax to be paid this month

Auto calculation of TDS based on Projections

Income Tax Projections with the options to deduct projected tds from

Monthly Salary

Prints Form 16, 12BA & Online Challan 281

Quarterly e-TDS Return as per the NSDL format

Income Tax Projections can be emailed in PDF format

Full & Final Settlement

Employees Full & Final settlement can be prepared based on resignation

of employees either in the current month or in the previous month

Automatically calculates outstanding Loan balances, Notice pay and

Leave Encashment , Gratuity and recovers all Loan balances and Income Tax.

Generates Full & Final Settlement Calculation sheet for all the

calculations done

User Defined Reports

User Defined Reports with the option to choose from the available

field, user can define his own customized columnar reports

Sorting, Grouping, Sub-total, Grand-total & Conditions can be

defined

Reporting

Output reports to screen, printer, MS Word & Excel

Option to preview Payslips / Salary Sheets or any other reports on

screen before final printing

Print Transaction & Master History for any period

Generating report is made easy with an advanced filter function to

select the relevant employees or groups for the report

Prints any of our report for the previous periods.

Data Import (Masters, Salary & Leave Record)

Employee & Payroll Data if available in Excel can Imported to

our software

HR Functions

General Information

Personal Information

Address/ Contact details

Employee Qualification

Family Members/ Emergency contacts/ PF Nominee/ LIC Nominee/ Gratuity

Nominee

Work Experience

Passport/Visa details

LIC details

Hobbies

Achievements

Vehicle/ Driving Licence details

Employee Trainings

Employee Appraisals/ Questions/ Question Groups/ Questionnaire Designer

Employees Documents/ Photos / Attachments

Employee Targets/ Commitments

Employee Skills

Complete Tracking of Employee Movement between Branches Departments/

Grades/ Designations

Various Reminder

Reimbursement & Claim Management

Creation of different reimbursement heads.

Employee can submit Reimbursement claim online.

Employee can attached soft copy of his reimbursement bills.

Reimbursement balance, entitlement, Summary, Ledger

Approval Workflow – Accepted & Rejected with auto mail Intimation

Online TDS Declaration Management

Employee can submit Income Tax Declaration Online

Employee can attached soft copy of his declaration proof.

Income Tax projection report – Projected & Actual Basis

Approval Workflow – Accepted & Rejected with auto email Intimation

Tax Planner

Enter the Investment details and get the instant projections for TDS.

Tax planning can be done with this tool easily, by testing various

combinations of testing and get the best combination.

User Rights

Users can be created

User Level Rights can be created and managed

Role based Security Model/ Assign rights to Payroll Officers for Managing

different groups of employees

Software Architecture

Completely Web based product

Designed using State of art technology. ASP.NET 3.5 + MS SQL

Software installation on clients machines are not

required. All authorized personnel can login to the system and do the required

functionality as per their rights

Audit Trails

Workflow

News

Announcements

Company Documents

FAQ

Kiosk

Polls

Query

SurveysLeave Application

Reimbursement Request

TDS Declaration

Employee Self Service Module

Each employee is provided with an online account

Employees can login and view their

Payslips

Yearly Salary Register

Loan / Advances Recovery/ Balance

Reimbursement Payments / Balance / Status

Income Tax Projections

Submit their Income Tax Declarations

Submit Leave Application

Submit Reimbursement Bills.

ESS gives employees direct access to their month-end / year-end paperwork.

They can download, print and save these documents themselves

Delivers significant cost & time savings for Payroll/HR department.

Improves administrative responsiveness & efficiency.

Enables greater employee satisfaction, fuels productivity

Other Add on Modules

Integration of Payroll Software with Tally

Cheque Printing Module